Charitable Gift Annuity

“I Just Love The Dressage Foundation!”

Charitable Gift Annuity is Not Just About the Lifetime Income

So said Shirley Jones, when she signed a $25,000 Charitable Gift Annuity Agreement with The Dressage Foundation on May 29, 2009. With her Gift Annuity, Shirley Jones has done two things simultaneously: made a $25,000 charitable gift, and purchased a fixed rate lifetime income. The numbers work like this: 1) a $25,000 donation, 2) a fixed rate 6% annuity, or $1,500 in annual income for as long as she lives, 3) 71.9% of the annual income is tax free, 4) she may take a charitable contribution income tax deduction of $10,118.50 on her 2009 income tax return. Shirley said about her Gift Annuity, “The permanent lifetime income checks are great, the tax advantages are also welcome, but basically I’m so proud to be helping The Dressage Foundation, an organization I greatly admire.”

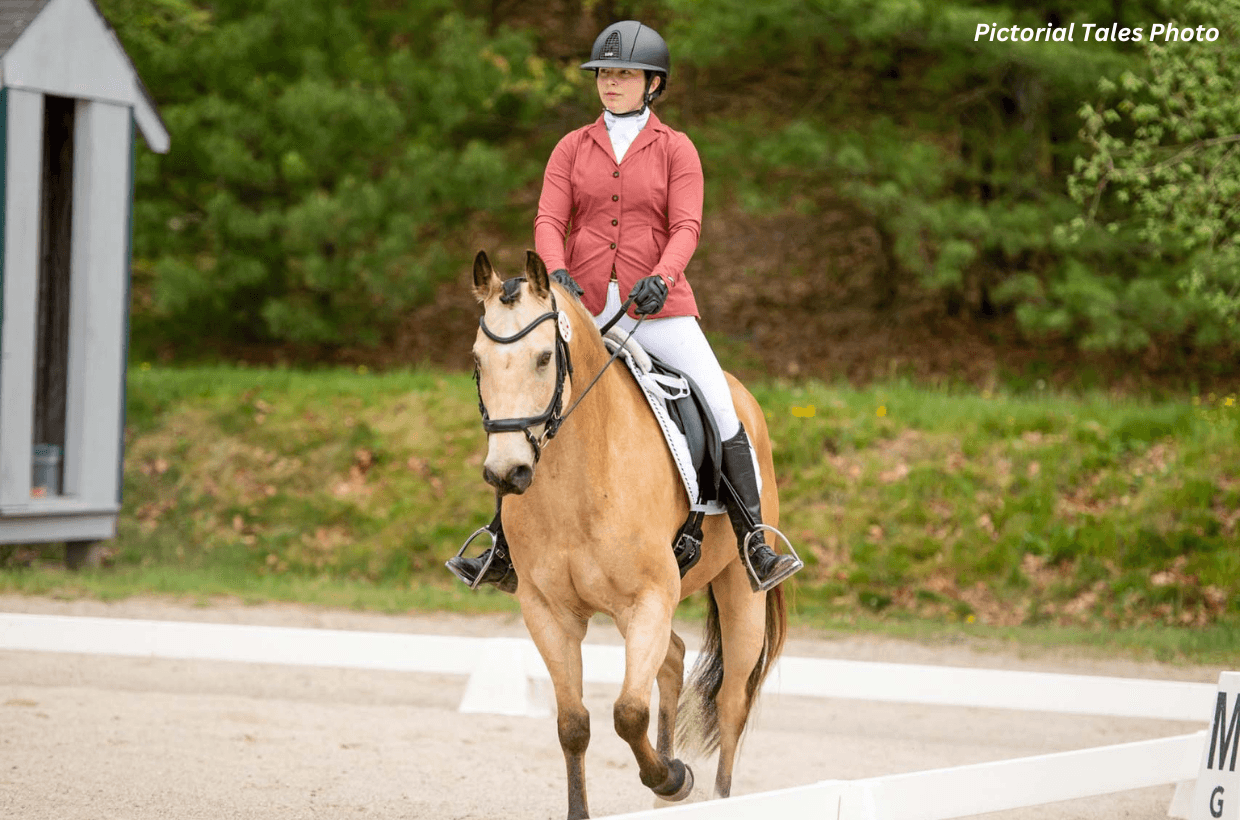

Shirley Jones and Dust Buster pictured on their “Century Club” ride in 2008.